Introduction

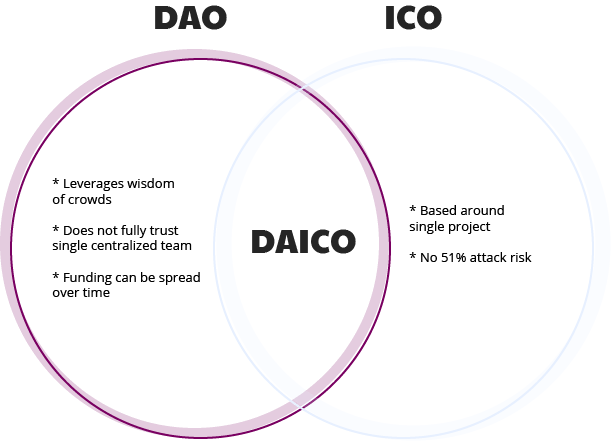

According to Pilkington (2018), the Daico is a new approach to raising the funds for the projects. The year 2017 was abuzz with the success of Initial Coin Offerings (ICOs) but the ICOS had their own advantages and disadvantages. The concentration of all the power in a single team that ran the ICOs was more of a risk for the investors than the profit. Therefore, in order to keep the fraudulent elements, such as, those who could hijack the investments in the crypto market, an amalgamation of Decentralised Autonomous Organisation and Initial Coin Offerings was created Hence, Daico emerged to safeguard the investors and to provide a new procedure of funding to them. Basically, Daicos starts with the contributions in the contributions mode, in this mode, everyone who is interested can acquire the tokens for an exchange of Ethrium (Pilkington, 2018). Ferretti and Gaina (2018) revealed that the exchange in the contributions mode can be any type of the sale that the team which running this decides. The enhanced feature of Daicos which was previously absent in the Initial Coin Offering is that the contribution mode lasts for a temporary time and once it is completed, no one makes the exchange for Ethereum. Moreover, in Daicos, the team that is responsible for development can only withdraw the total amount of investment only gradually, the entire amount cannot be withdrawn. Daicos remains in practice as an effect of raising the funding for the projects (Ferretti and Gaina, 2018).

DAICOS Model

In the previously used Initial Coin Offerings, Vigna and Casey (2016) argued that the enterprise based on the blockchain provided for a contract for all the processes of Initial Coin offering which monitored the entire process of collection of funds that were due for the investment. This contract, however, did not control the contributions made by investors or their utilisation. The contract gets over once the process of fundraising has been completed, then the investors start to keep an eye on the token to be listed so that those could make available for trading. However, Daico model has provided some better ways of doing this entire activity. In Daico, the investors, as well as the inventors, possess a connection with the development team of the fundraising process. In this way, both the sides become answerable to each other through a fair and digital organisational process (Vigna and Casey, 2016).

According to Delmolino et. al., (2016), it all begins with the creation of a DAICO contract in which both the contributors of the funds, investors and the development team come into contact with each other. All the processes starting from crowdfunding and collection of funds to their utilisation is performed in various stages of DAICOS module. These have been divided into the modes. The first mode is contribution mode, in this, a virtual meeting of the development team which is based on block-chain enterprise and the investors make their first contact in a secure way. Previously, ICOs were modelled in the same way but there always persisted a sabotage of the project. In order to overcome those hurdles, DAICO provided various safety nets in the form of different modes (Delmolino et. al., 2016).

According to King (2013), next to it is tap mode of Daicos. This is an advanced stage where the investors have already received the tokens for the exchange of cryptocurrency that will be utilised in carrying out the project. At this stage, the records of the utilisation of funds are tracked and the physical activities that are involved in the utilisation of the contributions of funds are also monitored so that no mishap can potentially be reported. Once the process of development has been started the two sides can also keep an eye on each other. For this purpose, general voting is done in two ways. First, the investors who have received their token can put forward their votes for setting the priorities on the tasks. Those activities that receive maximum voting are prioritised, secondly, in case the either of the parties is unhappy with the performance of the other, the entire contract can be terminated but that too cannot be done independently and consent through voting is required (King, 2013). The entire process has been explained in the detail given below.

The Contribution Mode

Park et. al., (2015) stated that the contribution mode keeps all the information about the activities that take place during the process of crowdfunding. The calculations and the methods about how the investors are going to make an investment, the quantum of the investment that they bring either in the form of ether exchange for some cryptocurrency or the fiat money all such information is contained in the contribution mode. Moreover, a variety of contribution modes can be defined in accordance with the specifications of the investors and those people who are involved in the team of block-chain project. A few of the different schemes that are available include Dutch auction, capped and uncapped sales based on tokens and the whitelist (Park et. al., 2015).

Gandal and Halaburda (2014) highlighted that once the contract mode has been completed and is terminated, no investor will be then able to put forward any contribution for the exchange. The moment contribution mode is closed and none of the investors is able to place any further contributions to the exchange of cryptocurrency then the phase of automation activates. This activation will further lead to the process of Tape Model. These processes have been designed in such a way that a sequence is followed and the room for any redundancy, overlap or misconduct are minimised. Because in the previous process of fundraising that based on the block-chain supported procedure of Initial Coin Offering, a few of criminalities were reported and more so could be performed, thus jeopardising the contributions of the investors. Hence, in Daicos, it is ensured that no such loophole exists and the fundraising is performed in a safer and an effective way. Next in the sequence of operations is Tap Mode (Gandal and Halaburda, 2014).

DAICOS Tap Mode

According to Fry and Cheah (2016), the operations of the contribution mode have resemblance with those of Initial Coin Offerings and in the same way, the Tap mode is likened to that of Decentralized Automated Organization making half of the overall Daicos process. Tap mode of Daicos saves all the modalities that are used in the guidance of the investors and the record of utilisation of the funds. It has already been mentioned that in Daicos the entire amount that has been contributed by the investors cannot be withdrawn by the developmental team of bloc-chain enterprise, only amounts can be taken out for the exchange and that too gradually. The Tap mode does not interfere in the utilisation of those contributions made in the contract mode but tracks the series of activities only that take place while the decisions of utilisation of fund contributions in the contribution mode are decided for exchange. At this stage, investors have already acquired the tokens for the exchange of cryptocurrency the developmental team of block-chain based developers in the project enter into a Decentralized Automated Organization DAO agreement (Fry and Cheah, 2016).

As per Ametrano (2016), a voting begins by the investors on deciding for the amount of money that is released to the developers’ team. At this point of the process, the investors can also decide on which of the aspects of the developmental project must be prioritised for the actualisation of the overall project. The tapping mode has been designed in such a way that neither the investors nor the development team can independently sabotage the progress of a given project and each can prevent other in case a misdeed is reported. One of the ways to do this can be through deactivating the existing DAICO or by the means of reduction of the tap amount, another way of preventing this is to start a new DAICO. The architecture of the tap mode has provided for two distinct categories of voting, the tap initiation and DAICO contract deactivation. It is pertinent to mention both of this voting system for better understanding the tap mode and DAICO (Ametrano, 2016).

The Tap Initiation Voting

Delmolino et. al., (2016) highlighted that the investors who are at the same time token-holders pledge a tap in order to initiate the releasing of funds. The same tap also includes the approval for the initiation of the voting process. This voting defines and prioritises the part of the project that has been selected to be done first in the presence of series of other activities. All of this process works as a component of DAICO. The tap initiation allows the concerned teams to for the most effective ways which can make the projects easier to complete and to help in the allocation of contributions given by the investors (Delmolino et. al., 2016).

The Contract Deactivation of DAICOS Voting

As per Gandal and Halaburda (2014), if such a situation arises where either of the parties are not content with the performance of each other, for example, the development team has been facing some kind of problem with the investor or the investors are having some trouble with the development team, the contract deactivation of DAICOS voting system helps to resolve such a situation. In this voting, both parties can vote for the deactivation of a DAICO. Whatever residual contributions are left with ether, are proportionally returned to the investors. This tool enables the development team and the investors to fully monitor the performance of each other for optimal outcomes (Gandal and Halaburda, 2014).

The DAICO Contract

Pilkington (2018) stated that the Daico contract mainly performs two roles. First, to govern the crowdfunding process and second, to control the utilisation of contribution of funds put forward by the investors that have been raised during the first phase of crowdfunding. A lot of criminalities started to emerge during the previous Initial Coin Offerings, the first part of the Daicos contract aims at making sure that no such activity is repeated again in future and the second part of the contract is a detailed analysis of remaining transactions that can help ensure the smooth running of the overall process. In the second part of the contract, it is ensured that the loopholes that existed in the Initial Coin Offerings are not repeated in Daicos. Based on the Daicos model, it is safe to assume that Diaocs itself is modified form ICOs that is safe in terms of funds utilisation and quality assurance. The second part of this contract is paramount to all other existing sources of crowd fundraising. This is the most comprehensive form of any fundraising because previously ICO could help in raising of the funds, it was unable to help in the utilisation of the contributions of the investors, whereas, Daicos offers completion of the project along with the security of monitoring the contributions and performance of the development team (Pilkington, 2018).

Advantages of DAICO model

Park et. al., (2015) revealed that the advantages of DAICO model can only be understood when it can be compared with other existing models that offer crowdfunding and similar funding platforms. By making an analysis of the preceding such platform of Initial Coin Offering there are certain flaws that can be witnessed. First, one of the major flaws of ICO system was that the contribution of the funds that was utilised for the purpose of various business operations could be withdrawn at any given point of time, thus the chances of fraudulent activities kept on increasing. In the DAICOS contract, no one can without consent withdraw all the amount, in fact, the only gradual amount can be withdrawn at a time and that too with the consent of both the parties. Moreover, one of the biggest advantages of DAICO is that it provides a voting system to the stakeholder in prioritising which activities to do first and which ones to perform at the second place. Lastly, Daico has remains an updated version of all the existing crowdfunding forums that can cater the fast-changing dynamics of the today’s investors (Park et. al., 2015).

Conclusion

In the end, it can be concluded that DAICOS remains a modern crowdfunding system, although it does not a long history and is a new platform it has been getting eminence very rapidly due to detailed and secure modes available in the processes.

References

- Ametrano, F. M. (2016). Hayek money: The cryptocurrency price stability solution.

- Delmolino, K., Arnett, M., Kosba, A., Miller, A., & Shi, E. (2016). Step by step towards creating a safe smart contract: Lessons and insights from a cryptocurrency lab. In International Conference on Financial Cryptography and Data Security (pp. 79-94). Springer, Berlin, Heidelberg.

- Ferretti, S., & Gaina, M. (2018). Blockchain and Smartcontracts: Fundamentals and a Decentralized Application Case-Study.

- Fry, J., & Cheah, E. T. (2016). Negative bubbles and shocks in cryptocurrency markets. International Review of Financial Analysis, 47, 343-352.

- Gandal, N., & Halaburda, H. (2014). Competition in the cryptocurrency market.

- Hayes, A. S. (2017). Cryptocurrency value formation: An empirical study leading to a cost of production model for valuing bitcoin. Telematics and Informatics, 34(7), 1308-1321.

- King, S. (2013). Primecoin: Cryptocurrency with prime number proof-of-work.

- Park, S., Pietrzak, K., Alwen, J., Fuchsbauer, G., & Gazi, P. (2015). Spacecoin: A cryptocurrency based on proofs of space (Vol. 528). IACR Cryptology ePrint Archive 2015.

- Pilkington, M. (2018). The Emerging ICO Landscape-Some Financial and Regulatory Standpoints.

- Scott, B. (2016). How can cryptocurrency and blockchain technology play a role in building social and solidarity finance? (No. 2016-1). UNRISD Working Paper.

- Vigna, P., & Casey, M. J. (2016). The age of cryptocurrency: how bitcoin and the blockchain are challenging the global economic order. Macmillan.